A fresh approach: The case for alternatives grows

The need for income and uncorrelated protection means alternatives have become staples in investor portfolios in recent years

As the longest ever economic expansion shows signs of weakness, ensuring investor portfolios are truly diversified is becoming crucial. That is particularly the case since government bonds, long viewed as a hedge in a simple 60/40 portfolio, now offer little in the way of income, and have often moved in tandem with risk assets in recent years, especially during inflation scares. It’s no surprise that alternatives have become an invaluable tool for advisers and investors alike.

‘It’s about finding alternative sources of income,’ explains Tom Davies, senior investment manager at Quartet Investment Managers. ‘We want fund managers that can provide an alternative source of return within our client portfolios.’

That need for income and uncorrelated protection has seen alternatives become staples in investor portfolios in recent years, says Kelli Byrnes, consultant within BlackRock’s portfolio and solutions team.

Slowing growth, the ongoing trade wars, and China’s subsequent yuan ‘devaluation’, have all pushed the total amount of negative yielding debt to £13 trillion in early August, a new record. And while central banks across the globe have turned more dovish of late, it is still unclear whether they can help kick-start a global economy that is in desperate need of a jolt.

So far, at least, the much-touted ‘green shoots’ have failed to emerge, and there are few signs that global growth has bottomed out just yet.

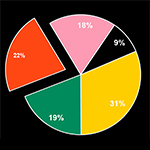

‘If you look at the alternative allocations across the portfolios we track, there’s a fair consistency around 20-to-25% allocation – across all risk profiles,’ Byrnes says. ‘The drivers of that, be it the potential for a recession or persistently low yields, don’t seem to be changing. So demand for true diversifiers, true alpha and higher yields, are not going away.’

Tom Davies, senior investment manager at Quartet Investment Managers.

Downside protection

In addition to alternative streams of income, the need for downside protection amid a slumping global backdrop has meant market neutral strategies – such as long-short equity, absolute return funds, and trend following funds – have become much more popular of late. That’s allowing clients to stay invested over the cycle, rather than sitting in cash and low yielding fixed income products.

‘We are quite focused on equity long-short at the moment,’ explains Jessica Milsom, senior associate at Stonehage Fleming. ‘Our investment committee has used that to dial up exposure, and to take down beta to the equity markets. It would be nice to find something similar in the credit space, but I don’t really see much change in terms of the philosophy and how we’re approaching the asset class.’

Even if central banks are successful in reviving global growth and demand and a major downturn can be avoided, there are reasons to believe returns on traditional assets like stocks and bonds could prove underwhelming.

‘Traditional asset classes, such as the 60/40 portfolio, are going to be very challenging to generate anything like the kinds of returns they have done historically’

William Dinning, chief investment officer at Waverton Investment Management

Demographic changes, for instance, are likely to weigh on growth in China, Europe and the US, just as they have done in Japan, while bonds and stocks have reached historic valuations in many parts of the world. That leaves less room for further appreciation, while the downside if these markets mean revert is substantial. The last decade, one of the best on record for investors of all stripes, is therefore unlikely to be repeated.

‘Traditional asset classes, such as the 60/40 portfolio, are going to be very challenging to generate anything like the kinds of returns they have done historically,’ remarks William Dinning, chief investment officer at Waverton Investment Management. ‘So that pursuit of alternatives, in our view, is going to continue, and I think you’re going to see more money going into the space.’

He adds: ‘People will be seeking ways to mitigate volatility and capital loss. But they’ll also be looking at ways they can generate income and capital. In other words, ways they can generate a total return. Investors and advisers will need to understand the alternative space better, since they will be allocating a lot more money to it in the future.’