Blackrock: an alternative provider with a truly global reach

The prestigious group is consistently ranked as one of the best overall asset management groups by Citywire each year.

Once a niche reserved for institutions and high net worth individuals, in recent years the alternative investment space has exploded. As well as there being more than 10,000 hedge funds of various strategies and size, there are also thousands of other more easily accessible solutions, including private credit, private equity and other real asset funds.

Yet with so much choice, how can one pick the right fund or provider, especially with so many of them overpromising and under-delivering in recent years. Cost, experience, transparency, and performance are some important metrics investors can look at, according Alex Orr, director within BlackRock’s alternatives specialists’ team.

‘There’s much more of a focus on truly uncorrelated returns nowadays,’ he explains. ‘Allocators are doing a lot more due diligence into the alternatives space right now. But a lot of these managers haven’t been around since 2008, and haven’t been able to prove themselves in different market environments.’

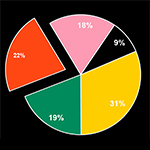

How does BlackRock compare then? ‘BlackRock is one of the largest alternative investors globally, investing across the entire spectrum of alternatives, both in liquid alternatives and in private markets,’ Orr says.

Alex Orr, director within BlackRock’s alternatives specialists’ team

Consistent performance

The US$6.52 trillion (£5.2 trillion) asset manager (as at 30 June 2019) invests in all major asset classes across the globe and is consistently ranked as one of the best overall asset management groups by Citywire each year. Its huge risk management division, which includes their multi-asset risk platform Aladdin, aims to position BlackRock portfolios to suit various market condition over the cycle.

That size, he adds, confers significant advantages when it comes to cost and experience. ‘Being a huge provider certainly helps. Not only are we very competitive when it comes to cost, we’re able to leverage the experience and expertise of thousands of investment professionals, across 35 offices worldwide. There really is a huge team and tech advantage to draw on, be it finding insights through “big data”, or credit and real estate opportunities in Latin America or Australia.’

The large scale also allows the firm to manage most of the investments in house. ‘We’re a very large alternatives provider, we mostly do direct investment ourselves. So we bring in specialist investment teams or we grow them in house and make sure they’re part of the BlackRock organisation. There are certain teams that will still outsource certain elements. Our private equity team will often invest in primary funds for external managers,’ says Orr.

‘Allocators are doing a lot more due diligence into the alternatives space right now. But a lot of these managers haven’t been around since 2008, and haven’t been able to prove themselves in different market environments.’

Alex Orr, director within BlackRock’s alternatives specialists’ team

‘We have unparalleled access as the world’s largest asset manager,’ he adds. ‘There are significant advantages when it comes to sourcing investments, corporate access and information, especially when you think of the global connectivity we enjoy across all the investment teams globally. There’s not many major deals we won’t know about or business executives we can’t contact.’

That information edge is a major plus, especially when the fund manager’s focus is on catalysts such as takeovers, restructures, mergers and management changes.

‘Portfolio managers can really take advantage of BlackRock’s first rate access to company management as part of the investment process. Once the information is captured, the team can use our risk platform to capture and hedge any risk,’ says Orr.

BlackRock also looks to tap into industry disruption to find the biggest winners and losers among the companies of tomorrow. ‘The team is always looking for companies that can disrupt industries or are exposed to long-term secular trends that are likely to do well,’ Orr notes. ‘At the same time, we short the “legacy incumbents” that are being left behind or actively disrupted.

‘Across all strategies, however, there is such a strong focus on leveraging our unique advantages and building portfolios that can really handle – and profit – from greater volatility and risk. As alternatives become a bigger and bigger part of investor portfolios, BlackRock is determined to make sure they grow this part of the business and stay ahead of the competition.’