Building better portfolios with alternatives

The Roundtable

Once considered esoteric and for the ultra-rich, alternative investments are now on the rise. With the longest ever bull market likely to end soon and the many geopolitical risks concerning the most patient investor, diversification remains key. This hub sheds a light on the role alternatives can play in this unsettling scenario, their real nature and how wealth managers can better use them to manage risk. It’s the result of a debate organised by Citywire and BlackRock with leading investors in the UK.

Video

Watch the highlights video of the roundtable on the meaning of alternatives, ramped up due diligence and transparency, the myths surrounding alternatives and how they fit in portfolios.

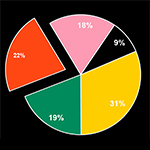

Infographics

Explore the essential story behind alternatives across these three infographics.

What are alternatives?

A fresh perspective on alternatives

How to use alternatives in a portfolio?

Listen

We have invited fund selectors to get a fresh view on the key themes of the roundtable event on the power of alternatives, chaired by Citywire in association with BlackRock. Listen to the podcast to discover whether alternatives is the way to go, and how these asset classes work for them in their portfolios.

This podcast has been independently created and produced by Citywire and not subject to editorial oversights by BlackRock.

Articles

Dive into the core of the discussion around alternatives, how to allocate to them, their future and to challenge what you thought you knew about them.

A fresh approach: The case for alternatives grows

Alternatives have become staples in investor portfolios in recent years as the need for income and uncorrelation to other asset classes has risen dramatically. So how are UK wealth managers approaching these asset classes?

What role do alternatives currently play in investors’ portfolios?

There is a need to clarify what alternative investments are before thinking about allocation. Wealth managers urge providers to solve the ambiguity around alternatives and offer their views on how to best allocate to them in their clients’ portfolios.

What role do alternatives currently play in investors’ portfolios?

There is a need to clarify what alternative investments are before thinking about allocation. Wealth managers urge providers to solve the ambiguity around alternatives and offer their views on how to best allocate to them in their clients’ portfolios.

Ramping up due diligence: are alternatives suited to everyone?

Can alternatives deliver on their promises? Due diligence is key today especially when reporting back to clients. As fund managers need to prove themselves now more than ever, what do wealth managers look at when selecting such investments?

Liquidity drain: how to face liquidity risks across alternatives

As liquidity continues to make the headlines when it comes to due diligence and transparency in the funds world, investors weigh in on its benefits, not only its risks.

Liquidity drain: how to face liquidity risks across alternatives

As liquidity continues to make the headlines when it comes to due diligence and transparency in the funds world, investors weigh in on its benefits, not only its risks.

Diversification: which alternative investments to use and use together?

Alternatives are a broad category of investments. What to pick and how to blend them in portfolios is not an easy task. Wealth managers and BlackRock’s specialists discuss the crucial aspects of picking the right mix of alternatives and understanding your funds in order to provide diversification.

Don’t fall for the common myths and misunderstandings

Do hedge fund managers still have that Wolf of Wall Street reputation or are perceptions changing? Are the truths around alternatives only with those working in the investment industry? The panel debates on how to demystify the myths around alternatives.

Don’t fall for the common myths and misunderstandings

Do hedge fund managers still have that Wolf of Wall Street reputation or are perceptions changing? Are the truths around alternatives only with those working in the investment industry? The panel debates on how to demystify the myths around alternatives.

Future allocations: how will these evolve, especially if there is a market downturn?

Sophisticated, but not complex products will be in so much need in the coming years as the longest bull market run in history comes to an end. Read how the alternatives markets is likely to fare in the future and how wealth managers are prepared to test their portfolios.

Blackrock and the power of alternatives

Why BlackRock when it comes to alternatives? The asset manager explains how its scale allows them to find the best opportunities globally, across the entire spectrum of this asset class.

Blackrock and the power of alternatives

Why BlackRock when it comes to alternatives? The asset manager explains how its scale allows them to find the best opportunities globally, across the entire spectrum of this asset class.