Ramping up due diligence: are alternatives suited to everyone?

The debate over whether alternatives can really deliver on their promises across an entire market cycle continues to rage

‘A lot of these funds did very well, both during the financial crisis and in the years proceeding. It’s interesting that so many have struggled, including some that gathered a lot of assets during that time,’ William Dinning, chief investment officer at Waverton Investment Management says.

The breakdown in negative correlation between equities and fixed income since 2013 has been part of the problem, he says.

‘There have been many periods where the correlation has become positive, which makes it very difficult if you’re running a fund predicated on buying uncorrelated assets and mixing them together to produce an uncorrelated return,’ Dinning says.

Tom Davies, senior investment manager at Quartet Investment Managers, agrees that the absolute return has faced challenges. ‘I think part of the problem is the obsession with risk management, at the expense of returns. Very low volatility targeting can throw out a negative real return.’

In addition, for the purposes of portfolio construction, meaningful volatility is needed to make a genuine offset to other asset classes, he points out. Thus the low volatility profile of some absolute return products means they have limited efficacy in overall risk management.

‘That’s been a real problem with the absolute return space. We tend to target the higher volatility funds, which might look a bit scary in isolation, but in fact they lower our overall portfolio risk because they have a meaningful uncorrelated return,’ he says.

The importance of due diligence has been highlighted recently in the world of mainstream funds, and is naturally also under scrutiny within the alternatives space. For Shane Balkham, chief investment officer at Beaufort Investment, while understanding the underlying strategies is essential, it can also be a challenge to communicate to clients.

William Dinning, Chief Investment Officer at Waverton Investment Management

Ultimately this comes back to client education, he believes. ‘If you have a fund that you need to perform in a narrow spectrum, and everything else is above it and doing phenomenally well, clients do look at the outlier and ask why it hasn’t performed as well as everything else. It’s up to us to explain to them that we are trying to build a diversified portfolio to do different things in different times,’ he says.

Heightened scrutiny

In a due diligence context, the relevance of examining longer-term track records is vital for Jessica Milsom, senior associate at Stonehage Fleming, who currently focuses on equity long/short strategies.

‘We’re very long-term investors and we like to invest across a full cycle. When we look at the managers we want to allocate to, we definitely look for durability of process and strong risk management. A genuine short-side skillset is also really important,’ she says.

If the manager doesn’t have a full-cycle track record in their current vehicle, Milsom will consider their previous history, which will often give an indication of how they have managed historically through a cycle.

Alex Orr, a director within BlackRock’s alternatives specialists team, also notes the increase in this type of scrutiny. ‘We’ve certainly seen, from our side, allocators doing a lot more due diligence than they have done before. You’re right to point out that there are not that many investment managers who have been around since 2008 and who have been able to really prove themselves in this slightly different environment. As a result, there has been a stronger focus on investment process and asset managers have reacted to that by providing greater portfolio transparency,’ he says.

‘We’ve had many discussions with clients who might ask why we didn’t invest in something – and then later we’d be proven correct – but at the time we are certainly put under scrutiny.’

Shane Balkham, chief investment officer at Beaufort Investment

Stripping out the return component that has come from market beta, particularly over what has been a largely sunny period for global equity markets, is an important aspect of due diligence for Kelli Byrnes, consultant within BlackRock’s portfolio analysis and solutions team.

‘This is one of the biggest challenges when looking at a manager’s track record: the best-performing absolute return managers may have been earning that return by taking on more market beta, but then that is not necessarily giving the diversification benefits clients need,’ she says.

‘This has been a major factor contributing to some of the frustration around absolute return funds: the fact that they don’t always deliver diversification when the markets are volatile,’ she continues.

Balkham believes it’s a matter of sticking to your guns and managing clients’ expectations. ‘It’s a matter of knowing the risk/return profile you want. The product doesn’t have to be first quartile over every time period as long as it’s giving you the diversification you need. So you work out where you expect the returns to be and if it’s way below sector average, that’s fine, because that’s what they should be doing,’ he says.

‘You need to be confident in what the fund’s doing and if it’s third quartile it’s our job then to explain to the clients that that is what it should be doing in that environment,’ he concludes.

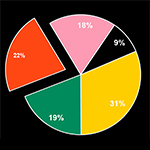

What role do alternatives currently play in investors’ portfolios?