Diversification: which alternative investments to use and use together?

There is no one way to play alternatives, but there are rules you can follow to make it a smooth process.

Due to the sheer array of products on offer, alternative investments are available to a far broader universe of investors than many traditional asset classes. While the non-traditional approach and structure of alternatives does pose certain risks, of which investors must be cognisant, they provide opportunities for experienced and skilled managers to greatly improve the risk-return characteristics of a portfolio.

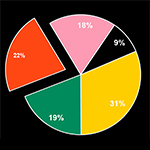

Many industry experts feel that one of the crucial questions for managers when it comes to using alternatives appropriately is to precisely define their role in the portfolio. Over the past year, the BlackRock Portfolio Analysis and Solutions (BPAS) team collected 600 portfolios from various investors across EMEA, a substantial dataset that has revealed certain trends, most notably that investors tend to have an ‘alts bucket’ that does not necessarily offer sufficient diversification.

It is important to combine a variety of different strategies involving combinations of alternatives in order to achieve a diversified portfolio, according to William Dinning, chief investment officer at Waverton Investment Management.

At Waverton, managers combine absolute return funds with real assets. The idea behind this is to try and mitigate volatility while having investments that can provide access to different kinds of risk premium than can be achieved through conventional equities or corporate credit.

But while some may baulk at the idea of absolute return funds, given that they have notably struggled in recent years, other managers argue that they still have the potential to add considerable strategic value. ‘I don’t think the people running these funds have suddenly become incompetent,’ says Dinning. ‘It’s probably more a change in market dynamics.’

Diversified relationships

Dinning and his team pay close attention to the relationship between the equity market and government bond markets, he says. From 2007 to 2013 this was always negative, with the gilt market in particular providing a good offset to equity market wobbles. Since 2013, the simple correlation between equities and gilts have become very unstable, he adds.

‘There have been lots of periods where the correlation has become positive and that makes it very difficult if you’re running a fund predicated on the idea that you can buy uncorrelated assets, put them together in a mix and produce an absolute return,’ he says.

While it might not be true for every market, in the UK for a sterling-based investor, it has become harder to get a 60/40 traditional portfolio and get diversification from that, Dinning says. ‘That is why I still think it’s worth thinking about absolute return and trying to find ways of doing it that actually do provide diversification and a lack of correlation in overall portfolios.’

However, when it comes to identifying suitable absolute return funds, one of the challenges is that some of them may have been earning that return by taking on more market beta. This may result in good performance but does not provide diversification.

‘It’s been very tempting for a lot of managers to chase equity momentum as it’s been a really successful trade, but you’ve got to be careful that you’re not buying active beta unknowingly,’ says Tom Davies, investment manager at Quartet Investment Managers.

‘It’s been very tempting for a lot of managers to chase equity momentum as it’s been a really successful trade, but you’ve got to be careful that you’re not buying active beta unknowingly’

Tom Davies, investment manager at Quartet Investment Managers

Keep it simple

As a result, experienced managers feel that one of the crucial aspects of picking the right mix of alternatives is being able to fully understand and break down the risk drivers in a particular fund to be confident that it can deliver the requisite outcome in a robust and sustainable way.

‘Understanding what you’re buying and stress testing that through particular periods where you need that manager to be dynamic or you need that manager to not be exposed to market beta is exactly what we’re working on with investors’, says Kelli Byrnes, a consultant within BlackRock’s portfolio analysis and solutions team.

As part of that, it is important to avoid alternatives that are too opaque or overly complex, says Shane Balkham, chief investment officer at Beaufort Investment. ‘We like a multi-strategy vehicle, which uses a lot of derivatives to generate different exposures in different markets. We prefer things that are simpler. The golden rule is that if we can understand it to a degree then we’ll use it. If it’s something we can’t really get our heads around, then we won’t touch it with a bargepole.’

Another very important factor is to find strategies that have been tested in different market environments, he says. ‘That is difficult at the moment, because we’ve only had one market environment for the last ten years. It makes trying to find something that has a track record more difficult.’

Liquidity drain: how to face liquidity risks across alternatives